PDD Holdings (NASDAQ:PDD), or Pinduoduo as it has been called, has shown explosive growth, thanks in part to the release of its shopping app Temu. Forecasts suggest that this very strong growth trend should continue in the medium term. However, PDD faces regulatory and political risks due to its Chinese origins, as possible Western policy changes could negatively impact the business, and that is why I am neutral on the stock.

What is PDD?

PDD Holdings is a multinational e-commerce giant. The company recently moved its headquarters from Shanghai to Dublin, Ireland, although to my knowledge there are very few employees working at the new headquarters. Originally known as Pinduoduo and registered in Dublin, the company was renamed PDD Holdings in February 2023.

PDD Holdings operates several business segments. The company’s flagship platform, Pinduoduo, is a leading social commerce app in China that focuses on group purchases to obtain significant discounts.

In addition, PDD launched Temu in 2022. This is PDD’s online marketplace designed for international markets, especially in North America. Temu leveraged Pinduoduo’s business model and technological infrastructure. Temu’s success was groundbreaking, attracting customers with competitive pricing.

Strangely, however, agriculture is the foundation of the company’s work. Through Pinduoduo, PDD has also made significant investments in agriculture, with the aim of revolutionizing the sector by connecting farmers directly with consumers. By reducing the middleman, the company says it delivers fresher products and better prices for both sides.

The influence of Temu on PDD

Although PDD does not break down revenue, given the attention the Temu app has received, it is very likely that Temu has become a key growth driver for the company. The North American-focused mobile app has more than 167 million monthly active users, and PDD’s revenue growth following the launch of Temu has been very strong. The app topped the download charts in 2023 and benefited from high-profile commercials, including during the Super Bowl.

In general, PDD has achieved incredible growth from 2016 – when revenue was $73 million – to 2023 – when revenue was $34.4 billion. The company’s earnings per share (EPS) have also increased significantly since the launch of Temu, from $3.99 in 2022 to $6.46 in 2023. From 2022 to 2023, PDD’s revenue increased from $19 billion to $34.4 billion.

In addition, Temu’s gross merchandise volume will reach $15.1 billion in 2023, which I believe must be estimates, while revenues are expected to reach $37 billion in 2024. This forecast suggests that Temu will account for more than half of PDD’s revenues in 2024.

PDD’s profit forecast is hard to believe

PDD’s growth curve remains impressive. Looking ahead, revenue is expected to grow from $34.4 billion last year to $57 billion in 2024, $71.2 billion in 2025 and $87.9 billion in 2026. After 2026, the number of analysts covering the stock drops drastically from 27 to just three. Only one analyst is covering the stock until 2033, when he believes PDD will generate revenue of $139.6 billion.

Now how does this translate to earnings? Earnings per share are expected to be $11.75 in 2024, rising to $14.91 in 2025. Earnings per share are expected to be $17.96 in 2026. This exceptional earnings growth appears to be largely attributable to Temu.

However, these projections could have little meaning if the regulatory or geopolitical environment worsens. Political tensions between the U.S. and China have led to increased scrutiny of Chinese technology companies, and former President Donald Trump has proposed imposing high tariffs on Chinese goods, possibly over 60%. This could affect PDD’s market activities in the U.S. if he returns to office.

Trump’s proposed measures are driven by a variety of concerns, including privacy and economic competition. It’s important to recognize that such a move could find bipartisan support, reflecting a tougher stance against Chinese technology companies and goods makers.

Based on current forecasts, PDD trades at 11.8 times forward earnings and has a price-to-earnings-growth (PEG) ratio of just 0.32 (a PEG ratio of 1.0 or less is generally considered undervalued).

Is PDD Holdings stock a buy according to analysts?

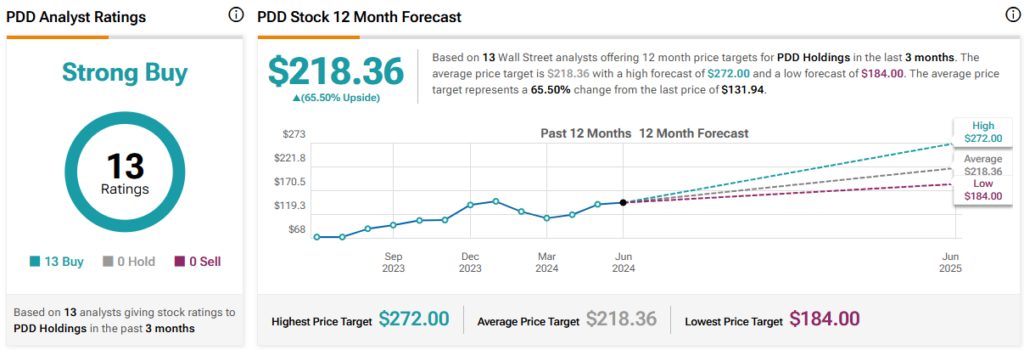

On TipRanks, PDD is rated a strong buy as analysts have issued 13 buy recommendations, no hold recommendations, and no sell recommendations over the past three months. The average price target for PDD Holdings stock is $218.36, implying an upside potential of 65.5%.

The conclusion on PDD Holdings shares

PDD Holdings has shown incredible growth over the past few years, and most analysts expect this growth to continue. Revenue will double in the medium term, and earnings are also on a strong upward trajectory. It also seems like the company is being overlooked, as evidenced by its PEG ratio of 0.32x. However, I am neutral, as geopolitical events and more protectionist US policies could end PDD’s success story.

Notice