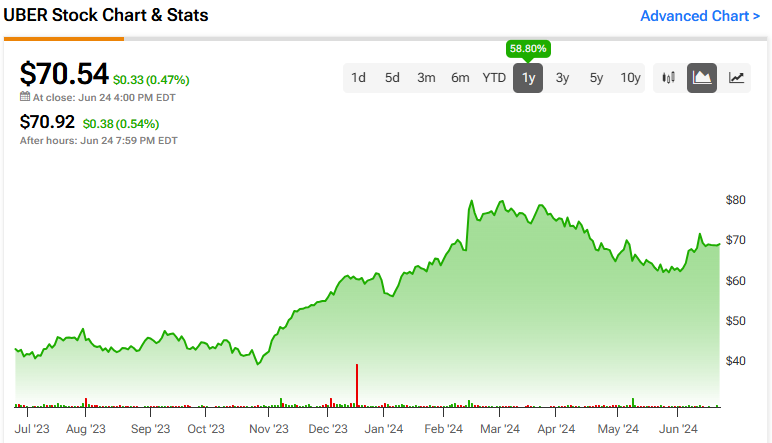

Above (NYSE:UBER), the leading ride-sharing company, has performed strongly over the past 12 months, although it suffered setbacks in the first quarter that caused the stock to lose some ground. Over the long term, the growth trajectory for both earnings and revenue appears robust, despite the potential threat that the transition to autonomous vehicles (AVs) poses to the company’s business model. Therefore, I maintain my cautiously optimistic stance on Uber at this time.

Why Uber has been in the red since its all-time high

Since hitting its all-time high in mid-February this year, Uber stock has underperformed. The exact reasons for this became clearer after the release of its Q1 results in May.

First, the composition of Uber’s core business has changed significantly. In the first quarter of 2020, the mobility segment (rides) contributed around 70% of Uber’s revenue. Today, however, this figure has dropped to 56%, mainly because Uber has expanded its presence in the delivery business (Uber Eats), which has become an important part of the business in recent years.

Comparing gross bookings in Q1 2024 with the same period last year, the overall increase is 20%. Within specific segments, the mobility segment grew 30% year-on-year in Q1 2024, compared to 39% growth in Q1 2023. In contrast, gross bookings in the delivery segment grew 18% year-on-year in Q1 2024, compared to 8% growth in Q1 2023.

I believe the market’s negative reaction is due to Uber’s slowing growth as the company pivots away from mobility, its traditional core business, which has historically played a critical role in the company’s growth and valuation.

Another factor that impacted Uber’s earnings in the first quarter, resulting in a loss of $654 million, was a one-time event. Uber reported a charge of $721 million related to investments in other companies such as DiDi (OTC: DIDIY). As the value of these investments declined, Uber had to reflect this loss in value in its financial reports. While resolving these issues was the right step toward transparency, it was certainly a blow to the stock price.

Will autonomous driving hurt or help UBER?

Another factor that could affect the company’s stock in the near future is the hype surrounding Tesla’s (NASDAQ: TSLA) Robotaxi strategy. Tesla’s plan to own and operate its own robotaxi fleet has sparked discussions about the potential impact of autonomous vehicles on Uber’s business model.

This could potentially shape the future landscape of ridesharing. However, should Uber adopt this disruptive technology, several assumptions can be made.

Uber’s transition to autonomous vehicles presents financial challenges due to the upfront costs of acquiring and maintaining an autonomous fleet. Currently, Uber drivers bear these costs themselves. However, if Uber moves to autonomous vehicles, the company would need to invest in purchasing or leasing those vehicles, which could be expensive initially.

Despite these initial costs, this transition would see Uber deploy AVs as robotaxis, maximizing fleet utilization and operational efficiency. AVs could operate nearly 24/7, unlike traditional vehicles that often sit idle.

In any case, according to Uber CEO Dara Khosrowshahi, the company is well positioned to master the transition to autonomous vehicles and be successful. He also mentioned that Tesla’s robotaxi project will need tools that Uber already has to make financial sense.

“I don’t think there will be only robotaxis anytime soon, and we believe there will be a transition as the technology becomes available. There will essentially be hybrid networks. And during that transition, we believe we are uniquely positioned as a marketplace to evaluate and offer any safe AV technology along with human drivers in our network.”

It’s notable that Uber sold its autonomous vehicle division to Aurora four years ago but is continuing the partnership. This smart move, in my opinion, should help Uber reduce operating costs while leveraging the technology at scale.

What lies ahead for Uber?

Looking ahead to Uber, the impact of autonomous vehicles (AVs) remains difficult to predict. However, other factors are currently more predictable that I consider to pose significant long-term risks.

A major concern is growing regulatory pressure. Although Uber is familiar with regulatory challenges, its size and market dominance make it a prime target of regulators. Litigation and regulatory action could potentially affect the company’s future profitability.

However, I am convinced that the growth potential of Uber’s core segments should remain robust at least for the next few years.

In terms of financial performance, Uber is expected to grow both earnings and revenue throughout 2024. Revenue is expected to grow 15.8%, while earnings per share are expected to increase 2%, resulting in a price-to-earnings (P/E) ratio of 79x. Looking ahead to the end of 2025, projections suggest a significant earnings growth of 137.5%, which could result in earnings per share of $2.11 and a 15% increase in revenue. This would bring the P/E ratio down to 33x and make Uber’s valuation significantly more attractive.

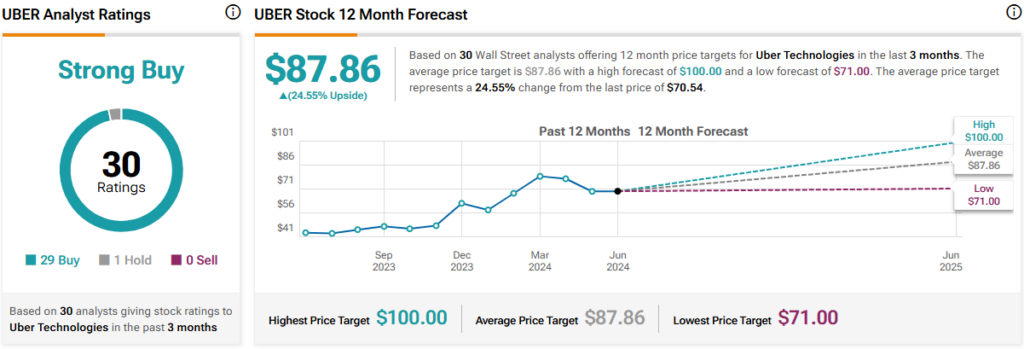

Is UBER stock a buy according to analysts?

Wall Street analysts agree that Uber has a strong buy rating, based on 29 buy recommendations and one hold recommendation over the past three months. The average price target for Uber stock among 30 analysts is $87.86, implying an upside potential of 24.6%.

The conclusion

While Uber faces challenges such as regulatory scrutiny and potential competition from autonomous vehicles that threaten its business model, I believe shifting the company’s revenue structure toward delivery services could help mitigate this risk.

Uber’s medium- to long-term prospects for revenue and net profit growth also appear promising, driven by expected improvements in profitability and financial metrics.

While Uber is not currently considered a low-cost stock, I do not consider it expensive relative to its growth profile, so I remain cautiously optimistic about Uber’s long-term prospects.

Notice