Gold prices have been moving sideways this month as the US dollar has gained strength in global markets. The XAU/USD index, which tracks gold price movements, shows the price hovering around $2,325 at the start of trading on Tuesday. It has dropped almost 9 points on the charts and lost 0.38% of its value in the last hour.

Also read: Currency: Indian rupee loses value against the US dollar

Now that the price of gold has fallen behind, the question is whether the precious metal can recover and gain ground in the indices. In this article, we present a price forecast for gold for July 1, 2024.

Also read: Shiba Inu hits 62 cents? Here’s when SHIB could hit $0.62

July 1, 2024 Gold Price Prediction

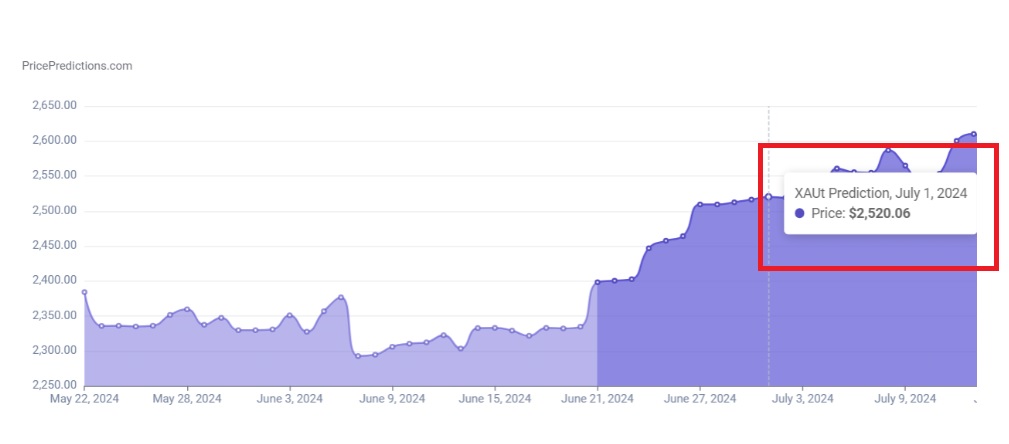

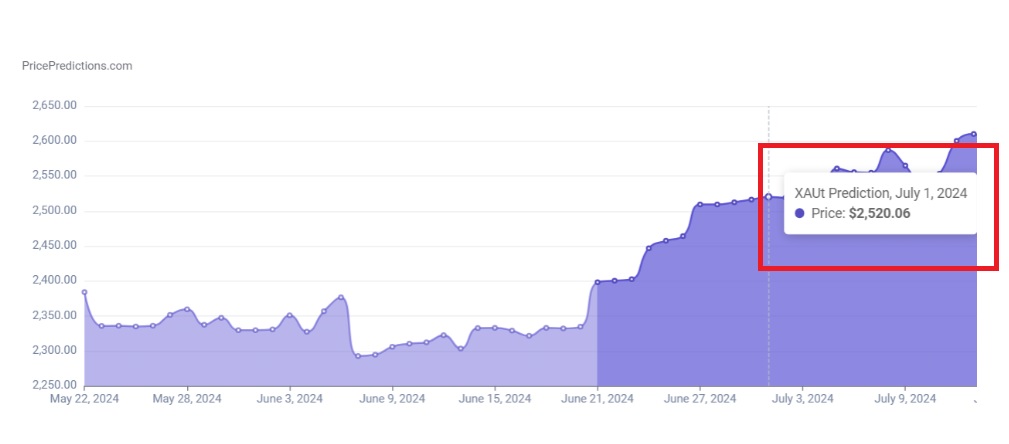

The leading on-chain metric “PricePredictions” paints an optimistic picture for gold for July 1, 2024. According to the price forecast, the precious metal could start a rally and generate profits in the next five days.

Also read: Petrodollar: US dollar in danger if Saudi Arabia no longer accepts the USD

PricePredictions estimates that the price of gold could exceed the $2,500 mark in July 2024. The forecast assumes that the price of gold could reach $2,520 on July 1, 2024.

That’s an increase and a return on investment (ROI) of about 8.5% from the current price of $2,325. Therefore, a $10,000 investment could turn into $10,850 if the prediction proves accurate next month.

Also read: BRICS: China warns of trade war with the European Union

Commodities have outperformed the stock market this year, posting double-digit returns in six months. While silver has made the biggest gains at 27%, copper has generated 23% of the gains in 2024. In third place is gold, which has returned about 18% year-to-date. The U.S. dollar has also returned nearly 5% year-to-date, and the commodities market has outperformed the global stock market.

Demand for copper and silver for industrial purposes has reached a peak, causing prices to soar. In addition, the conflicts in the Middle East are causing institutional funds to open positions in gold and the US dollar. This development is causing the price of gold and the US dollar to reach new highs this year.