ANYCOLOR Inc. (TSE:5032) has had a truly impressive month, gaining 27% after a shaky period earlier. Not all shareholders will be cheering, as the share price is still down a very disappointing 14% over the last twelve months.

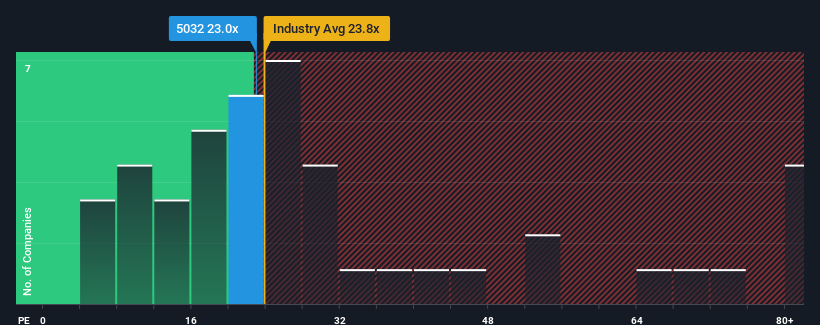

After the sharp price increase, ANYCOLOR’s price-to-earnings (P/E) ratio of 23 might seem like a strong sell right now compared to the Japanese market, where about half of the companies have P/E ratios below 13 and even P/E ratios below 9 are quite common. Still, we would have to dig a little deeper to determine if there is a rational basis for the greatly elevated P/E ratio.

ANYCOLOR could be doing better as its earnings have been declining recently while most other companies have been reporting positive earnings growth. It could be that many are expecting the dismal earnings performance to rebound significantly, which has prevented the P/E ratio from collapsing. One would really hope so, otherwise one is paying quite a high price for no particular reason.

Check out our latest analysis for ANYCOLOR

If you want to know what analysts are predicting for the future, you should check out our free Report about ANYCOLOR.

What do growth metrics tell us about the high P/E ratio?

To justify its P/E ratio, ANYCOLOR would have to deliver outstanding growth that significantly outperformed the market.

If we look at last year’s earnings, the company’s profits have fallen by a disheartening 29%. Despite this, overall earnings per share have increased by 300% year-on-year, regardless of the last 12 months. Accordingly, shareholders would likely welcome medium-term earnings growth rates, even if they would have preferred to see the upswing continue.

Looking ahead, the four analysts covering the company expect earnings to grow 16% annually over the next three years, while the rest of the market is forecast to grow at just 9.6% per year, which is much less attractive.

With this information, we can see why ANYCOLOR is trading at such a high P/E compared to the market. It seems shareholders are not interested in dumping something that potentially has a better future ahead of it.

The conclusion on the P/E ratio of ANYCOLOR

ANYCOLOR’s P/E ratio is as high as it has been in the last month. Generally, we prefer to use the price-to-earnings ratio only to determine what the market thinks about the overall health of a company.

As we suspected, our study of ANYCOLOR’s analyst forecasts revealed that its above-average earnings outlook contributes to its high P/E ratio. Currently, shareholders are happy with the P/E ratio as they are fairly confident that future earnings are not at risk. Under these circumstances, it is difficult to imagine the share price falling much in the near future.

It is always necessary to consider the ever-present specter of investment risk. We have found 1 warning sign with ANYCOLORand understanding it should be part of your investment process.

You may find a better investment than ANYCOLOR. If you want a selection of possible candidates, check out this free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

Valuation is complex, but we help simplify it.

Find out if ANY COLOR may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if ANY COLOR may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]