- XRP’s daily and weekly charts were flashing red at press time

- While some indicators seemed optimistic, the rest indicated something else

Like several other cryptocurrencies, XRP has also seen several corrections over the past week. However, investors may soon see a trend reversal, especially as a bullish pattern appeared on the XRP chart. Thanks to it, the token seemed to be on the verge of a breakout.

Therefore, it is worth taking a look at the current status of XRP to better understand what to expect in the short term.

A bullish pattern on the XRP chart

According to CoinMarketCap, the The price has dropped by almost 2% in the last 7 days. This downward trend has continued in the last 24 hours as well. At press time, the altcoin’s value was $0.4755 and its market cap was over $26.4 billion.

However, better news may be on the way. ZAYK Charts, a popular crypto analyst, recently shared a tweet Highlighting a bullish falling wedge pattern. XRP had started consolidating within the pattern in March and at the time of writing, it appeared to be on the verge of breaking out of it.

According to the analyst, a successful breakout could lead to an increase of 30 to 40 percent in the coming days or weeks.

Is an outbreak possible?

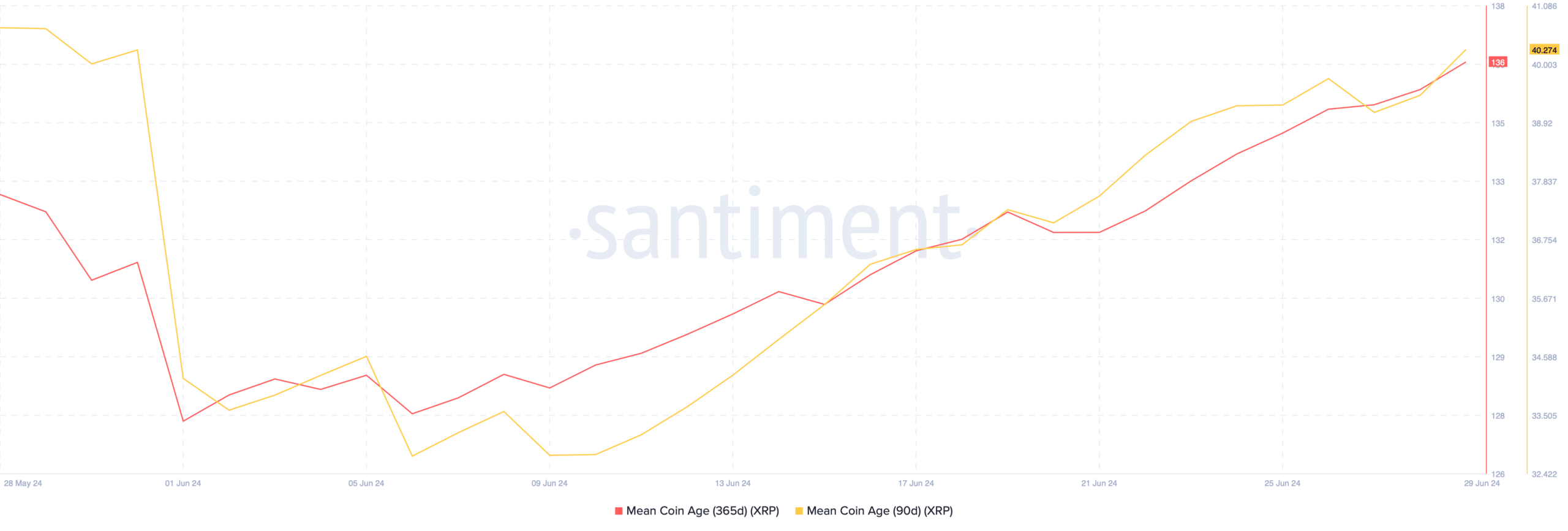

Since XRP may be on the verge of breaking out of the bullish pattern, AMBCrypto analyzed its on-chain data to see if this possibility is supported. Our analysis of Santiment’s data revealed that investor confidence in XRP is high.

Both the token’s average coin age of 1 year and 90 days saw massive increases over the past month. Taken together, these metrics indicated an increase in the number of coins that have not moved on the blockchain in the past year and 90 days.

Source: Santiment

AMBCrypto’s analysis of Hyblock Capital data also revealed an interesting relationship between the price of XRP and its cumulative liquidation delta.

We have observed that when the token’s cumulative liquidation delta turns green, the token’s price trend slows down or decreases. On the contrary, when this metric turns red, it is usually followed by a price increase.

At the time of writing, this value was -785, which indicates an imminent price increase in the charts.

Source: Hyblock Capital

However, some of the key figures looked pessimistic. For example, Coinglass’s Data suggested that the token’s long/short ratio has declined – a sign of a generally increasing pessimistic sentiment.

In addition, it is Fear and Greed Index was also in a “greed” phase at the time of writing. Whenever the indicator reaches this level, it indicates that the probability of a price correction is high.

Is your portfolio green? Check out the XRP Profit Calculator

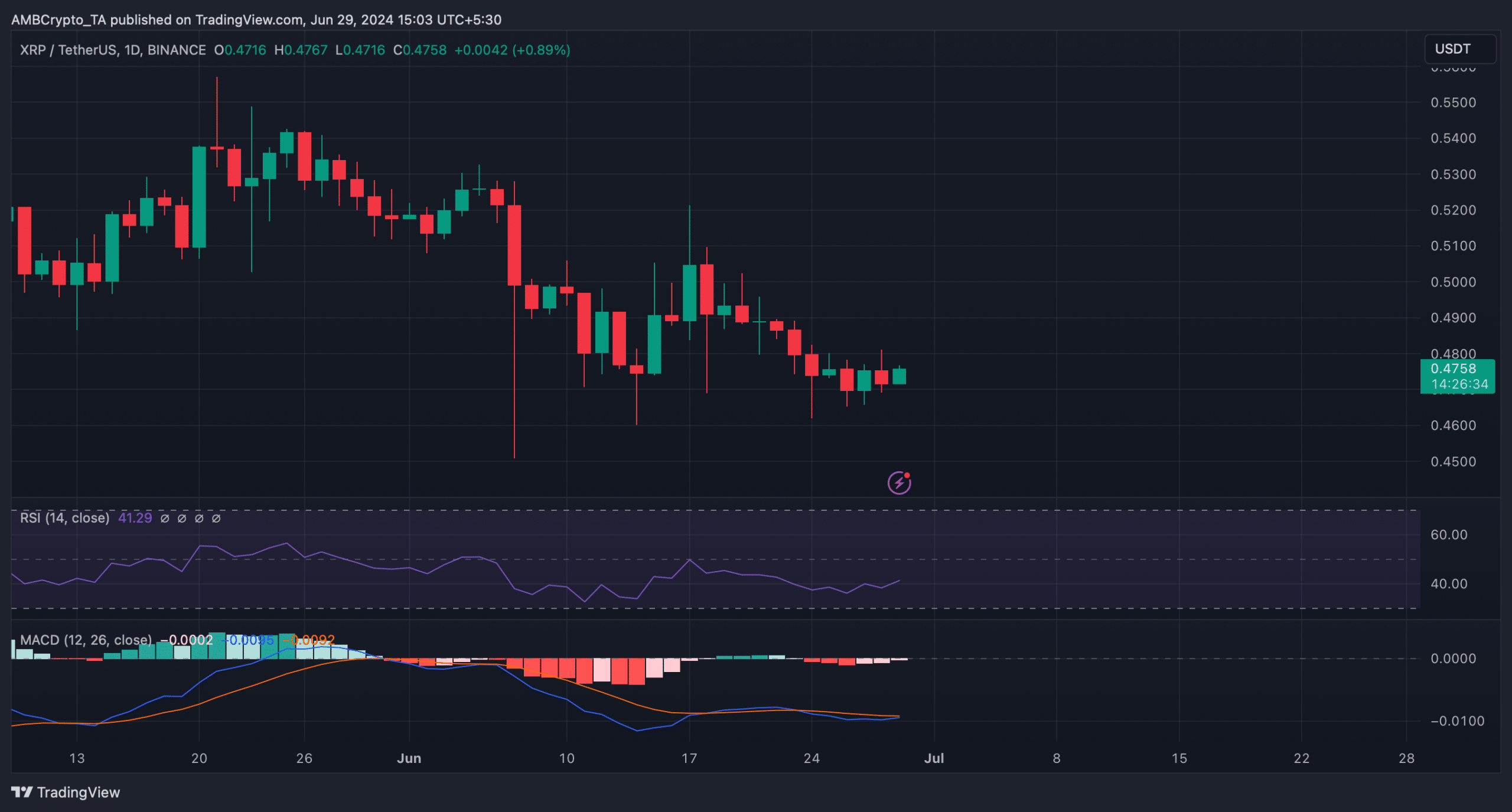

Nevertheless, the Relative Strength Index (RSI) was trending up. The MACD also flashed the possibility of a bullish crossover – further evidence that XRP could successfully break out of the falling wedge pattern.

Source: TradingView