- Within 24 hours, investors’ expectations changed from pessimistic to optimistic.

- The price of TON could continue to rise with the surge in net positioning.

Things change very quickly in the crypto market, and it is no different for an altcoin like Toncoin (TON). This time, it was not only about the price.

Instead, the focus was on the activities of traders in the market, particularly derivatives trading.

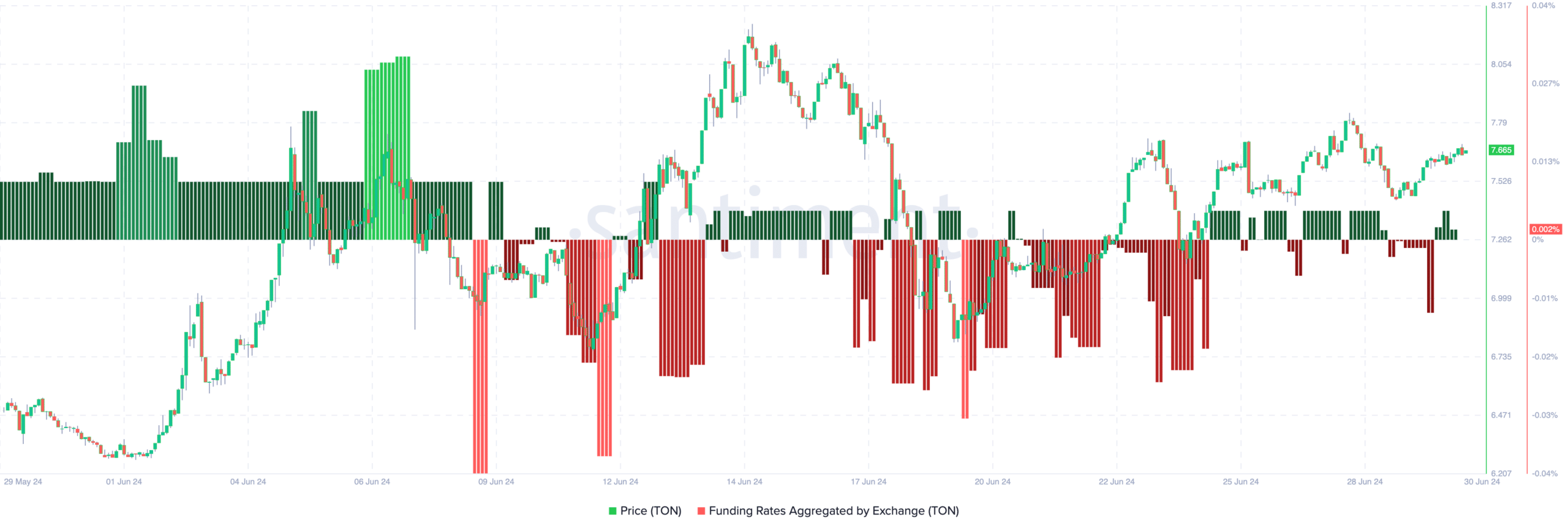

According to Santiment, TON’s funding rate was -0.012% on June 29. However, at the time of writing, the ratio had jumped back into positive territory at 0.002%.

The funding rate refers to the cost of keeping a contract open in the market. However, it also measures the nature of expectations. For example, if the value is negative, it indicates a pessimistic sentiment.

Bears become bulls

In this case, shorts (those expecting a price drop) pay longs (those betting on price increases) to keep their positions open. But when the price is positive, it is the longs that pay shorts.

Therefore, the change within this short period of time means that a large number of traders now expect a Toncoin price increase. They also expect to profit from the increase.

Source: Santiment

At press time, TON’s price was $7.66, up 2.01% in the last 24 hours. Surprisingly, this slight decline helped the project to rank among the top 10 gainers in the entire crypto market.

Currently, Toncoin is 6.97% below its all-time high (ATH). The token reached its ATH on June 15, when the price reached $8.24.

Furthermore, the fact that the TON price and funding rate were increasing indicated that buyers were aggressive and buy orders in the spot market were skyrocketing, meaning traders were being rewarded for their positions.

The cash flow increases and puts TON on the right track

This is bullish at this price. Therefore, we could see TON slowly rise again to $8 in the short term. However, it is also important to evaluate the open interest (OI) to confirm the thesis.

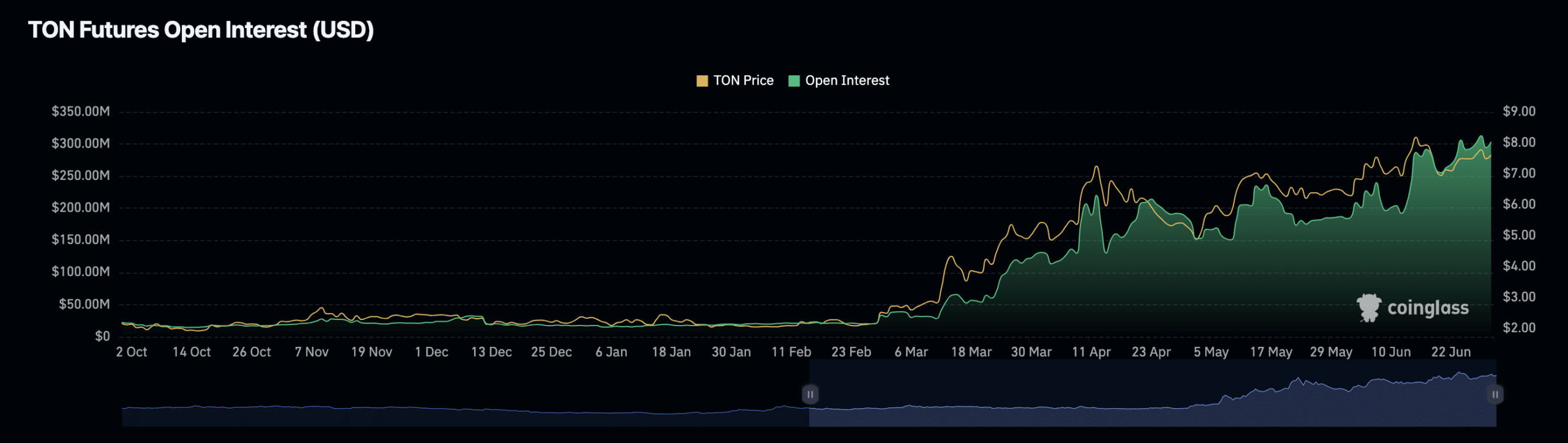

OI refers to the total value of open contracts. It is important to note that this indicator does not show whether there are more long positions than short ones. This is because for every long position, there is a short position.

The signal it shows is whether net positioning is increasing or not. An increase indicates an increase in net positioning, while a decrease suggests the opposite.

According to Coinglass, Toncoin’s open interest was $303.53 million, which was also an increase, meaning that speculative activity increased compared to the previous day.

Source: Coinglass

Realistic or not, here is the market cap of TON in BTC

If this continues in the next few days, the TON price would most likely continue its uptrend.

However, if the OI drops later, the price could head south. In this case, the cryptocurrency’s value could drop to $7.25.