- The price of Ethereum has fallen by over 3% in the last 7 days

- A key metric showed that ETH was undervalued, suggesting a recovery on the charts

Ethereum (ETH) The price action turned bullish on June 28, giving investors hope of a recovery from their previous losses. Unfortunately, this bullish trend did not last long as the coin saw a price correction shortly after. This resulted in both its weekly and daily charts flashing red.

Ethereum faces rejection

Following the aforementioned price surge, ETH bears made another gain, pushing the altcoin’s price down by more than 3%. At the time of writing, the king of altcoins was trading at $3,391.51 and had a market cap of over $407 billion.

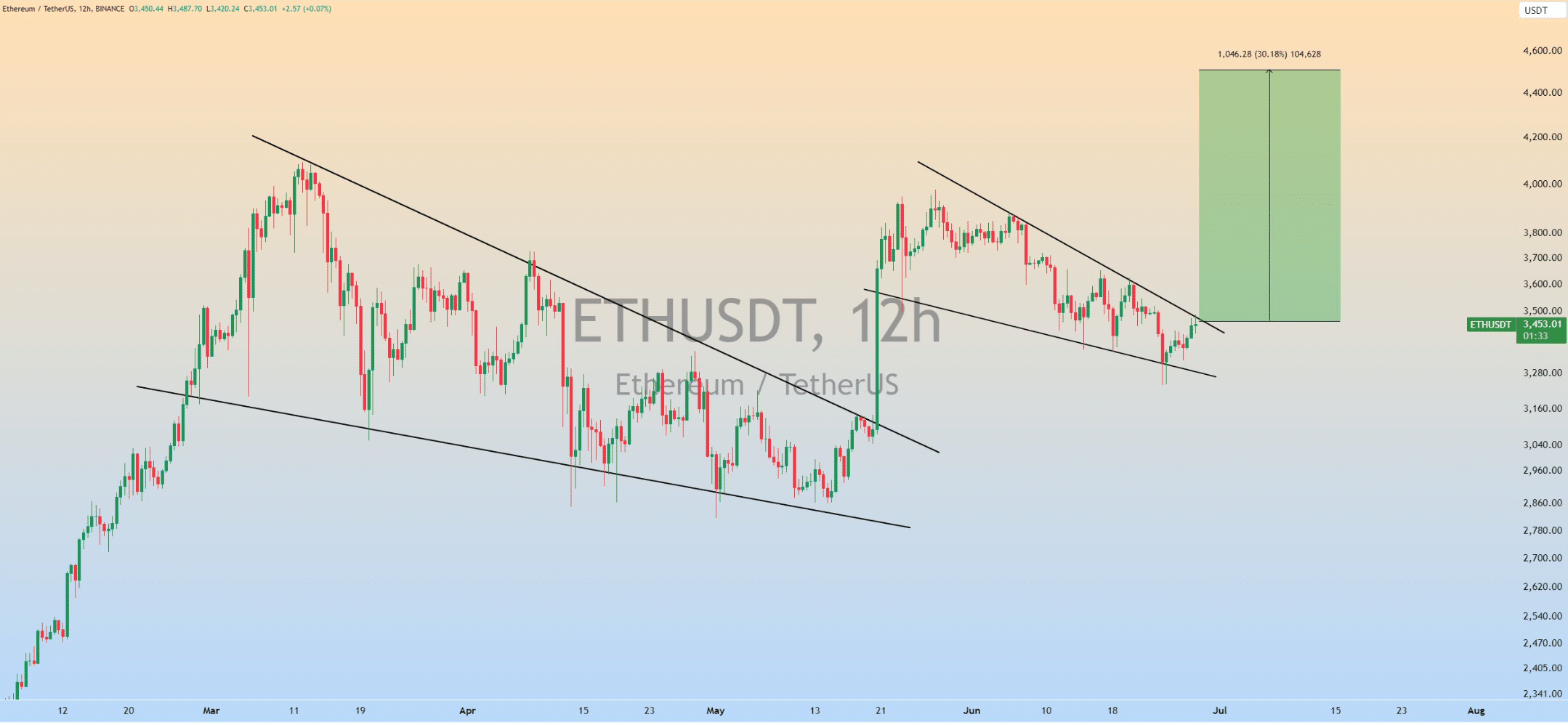

The worst news was that Ethereum was rejected from the upper boundary of a bullish wedge pattern in the recent past. According to a tweet According to ZAYK Charts, a well-known crypto analyst, the token’s price began to consolidate within the pattern in late May. A successful breakout could have resulted in a 30% price increase that would have allowed Ethereum to cross the $4,000 mark.

Interestingly, a similar pattern had already emerged in early March, which then broke out in May, taking the altcoin to $3,89000 on the charts. However, since ETH was rejected this time, the chances of history repeating itself are slim.

Source: X

Will ETH not recover?

AMBCrypto then took a closer look at Ethereum’s current state to see if it would fail to break out of the bullish pattern.

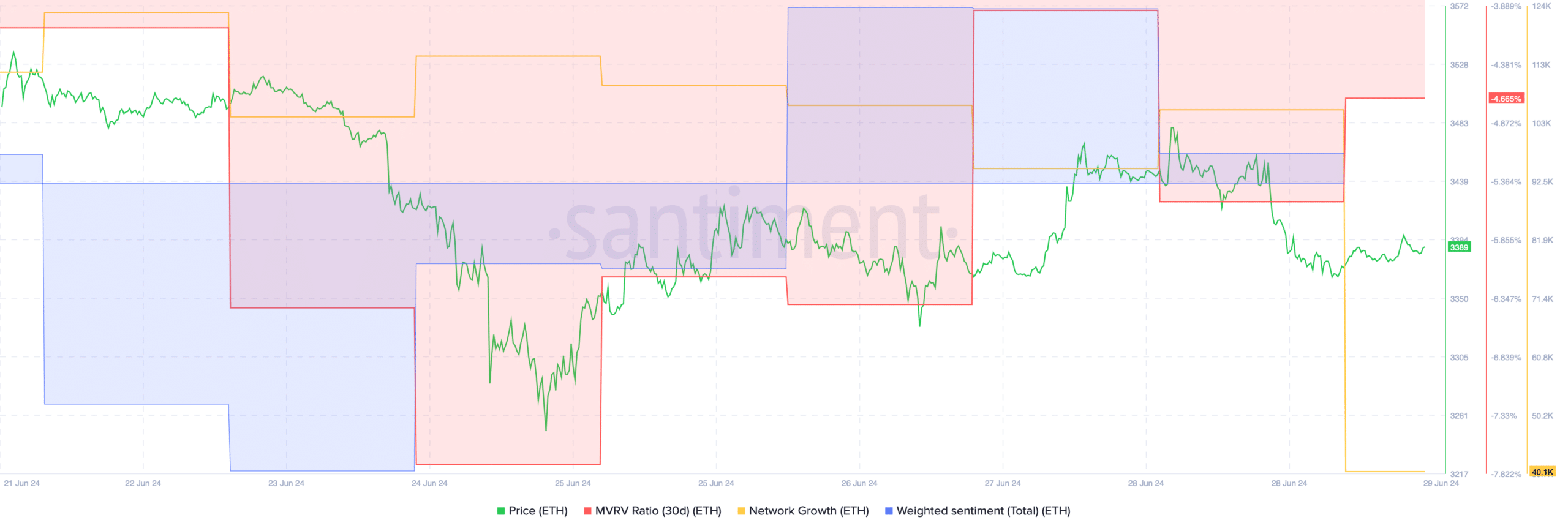

We noticed that the market sentiment surrounding the king of altcoins remains bearish, as evidenced by the decline in weighted sentiment after the peak on June 28. Network growth also declined slightly, meaning fewer addresses were created to transfer the token.

Source: Santiment

Nevertheless, some indicators pointed to a successful breakout.

For example, the MVRV ratio has improved in recent days, which can be interpreted as a bullish signal.

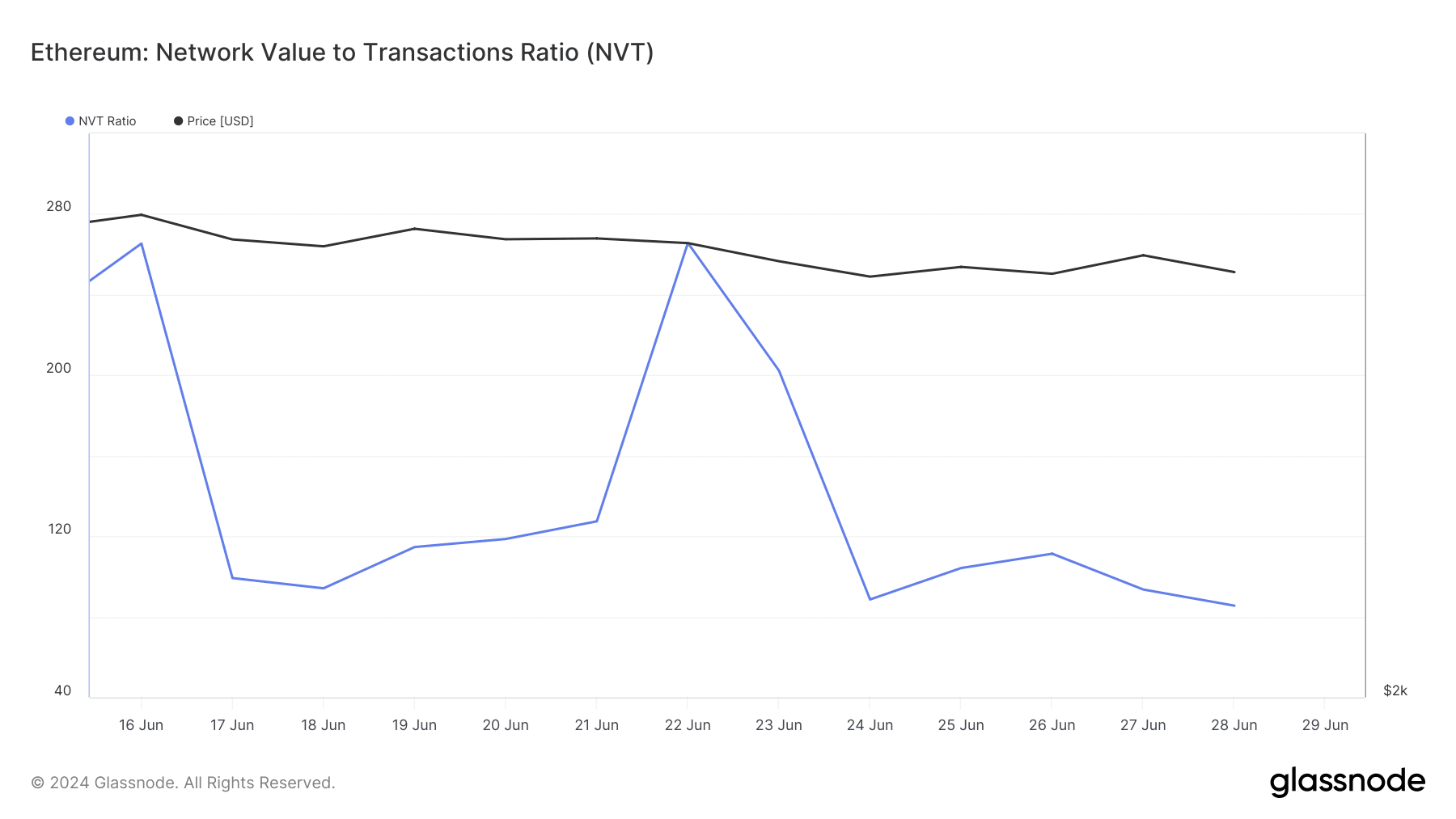

AMBCrypto’s analysis of Glassnode’s data also revealed that Ethereum’s NVT ratio has dropped sharply. A drop in this metric usually means that an asset is undervalued – implying an impending price increase.

Source: Glassnode

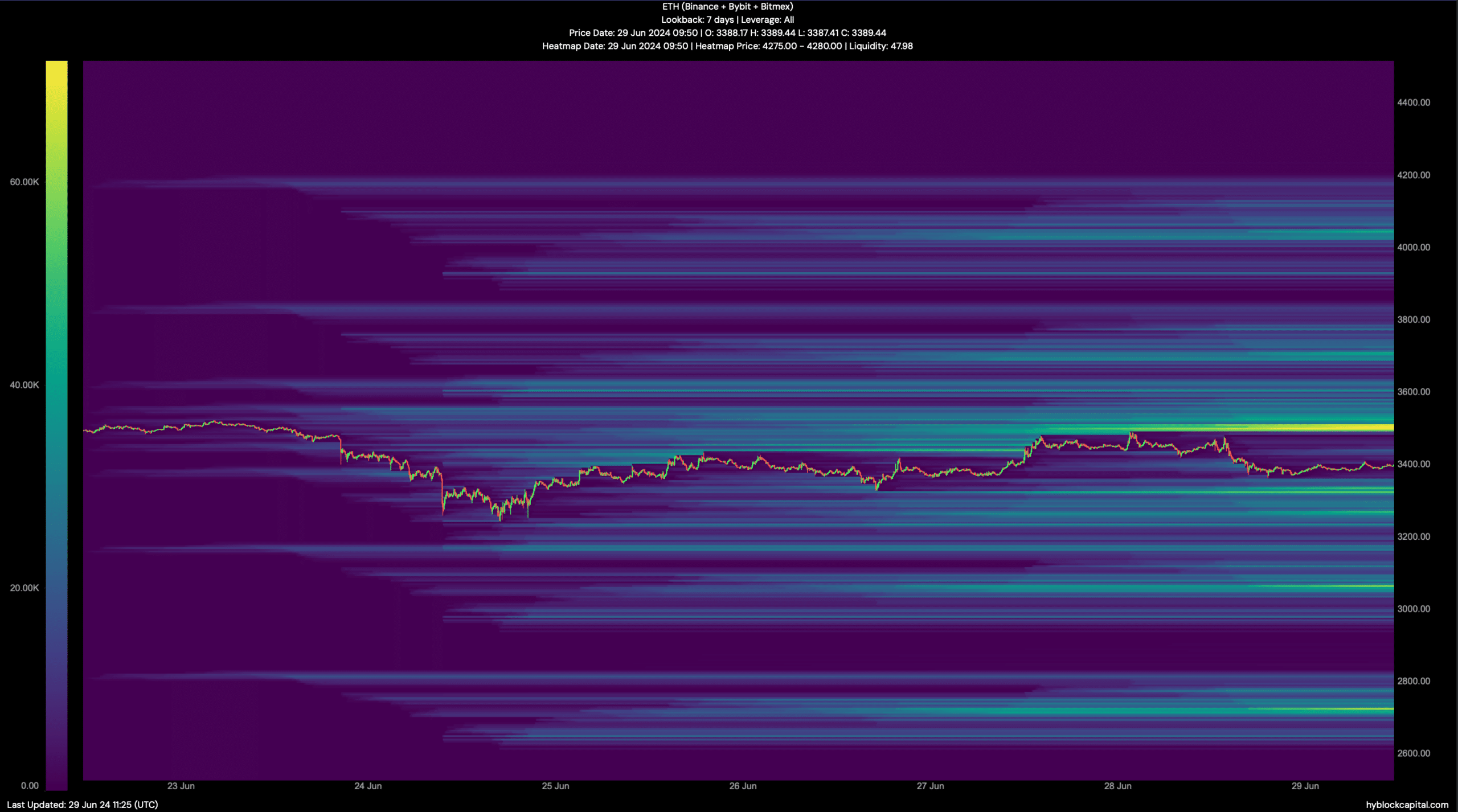

AMBCrypto then looked at data from Hyblock Capital to look for immediate support and resistance levels.

According to our analysis, it would be crucial for ETH to reach and break above the $3,500 mark to sustain a bull rally as liquidations would rise sharply. Generally, a rise in liquidations often leads to price corrections on the charts.

Is your portfolio green? Check out the ETH Profit Calculator

On the other hand, if the bears continue to dominate and ETH’s volatility rises south, the price could drop to $3,060.

Source: Hyblock Capital