- AVAX rose 11.92% in the last 7 days

- Coinbase Derivatives has now applied for AVAX futures certification with the CFTC

Avalanche (AVAX) continues to defy market trends with a sustained rise on the charts. Although most altcoins have seen sharp declines, AVAX remains strong and has a good chance of rising amidst BTC’s volatility. In the last 7 days alone, various factors have driven AVAX’s positive price action.

First of all, Coinbase Derivatives recently made headlines after officially filing certifications with the CFTC to offer US-regulated futures for AVAX. In addition, Coinbase will also consider LINK, DOT, Stellar, and Shiba Inu futures.

This is an important milestone as it will increase investor confidence in the altcoin. Furthermore, institutional and other retail investors will view AVAX as a mature asset that will attract the attention of major market participants.

But that’s not all, as Moongate has also announced the integration of AVAX. In a post on X, the team explained:

“We’re excited to announce that Moongate has just integrated with @avax! With #Avalanche we’re bringing a new level of transaction efficiency and security to our platform.”

These developments are positive affirmations for AVAX that can potentially influence market sentiment and activity. In fact, these moves have made analysts optimistic, and many are now predicting huge gains for AVAX. For example, well-known analyst John Mayer shared:

“$AVAX price rose sharply today before slightly paring gains on consistent volume. We’ve reclaimed $28; $30 should be our next target. #Avalanche is currently focused on gaming partnerships with small but growing #DeFi apps and increasing #NFT activity.”

What do key figures say?

Well, the forecasts of most analysts and the market developments speak for AVAX, but what do the key figures say?

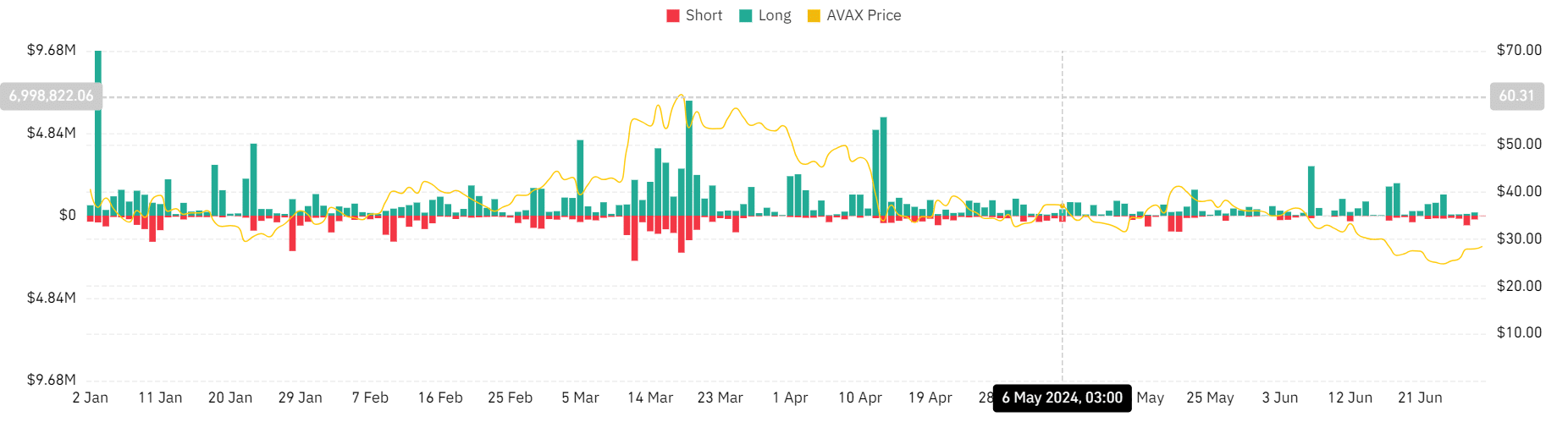

Source: Coinglass

AMBCrypto’s analysis revealed that AVAX is on an uptrend and will continue to do so. Our analysis of Coinglass’ data also pointed to lower liquidation rates for long position holders and higher liquidation rates for short positions.

Higher liquidations on short positions are a sign that investors betting against the market are running out of money. Since June 25, short position holders have been forced to close their positions while long positions continue to be held and new ones opened. This can be interpreted as a bullish signal.

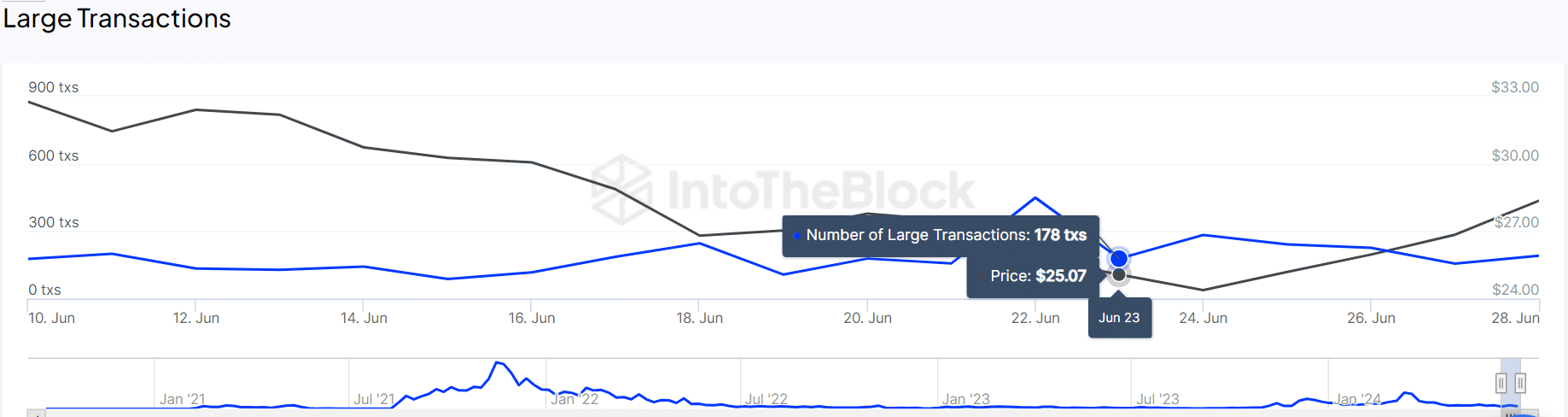

Source: IntoTheBlock

According to IntoTheBlock, AVAX has been going through an accumulation phase over the past 7 days. During this period, large transactions increased by 280%. This activity led to increased buying pressure, thus driving prices higher.

What do the price charts say?

Since the market has low liquidity for long positions, a higher number of large transactions indicates an accumulation phase.

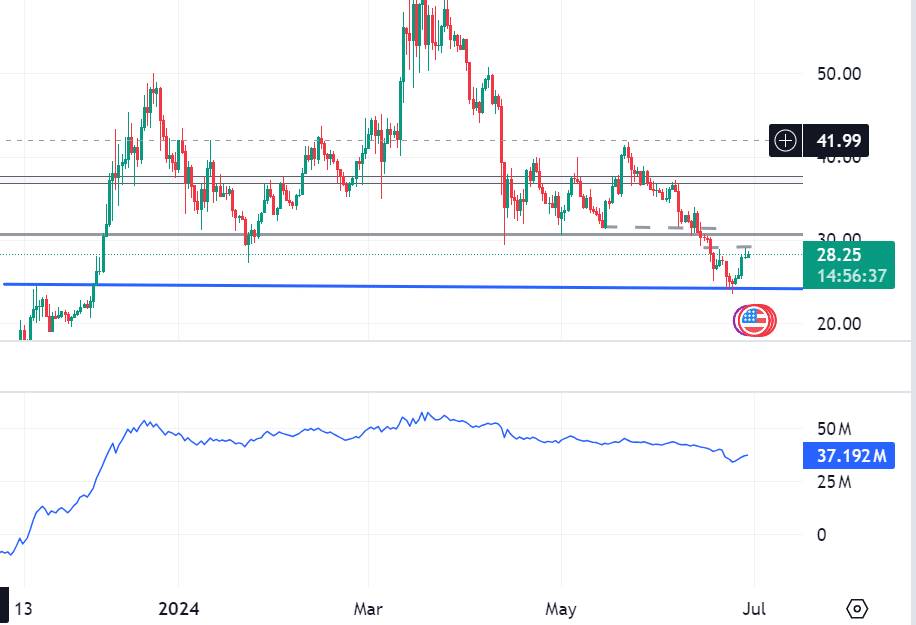

Source: Tradingview

Looking more closely, the OBV has risen over the last 7 days from a low of 33 to 37 at press time. A rising OBV is a sign of volume on the buy side, which leads to a price increase and bullish behavior.

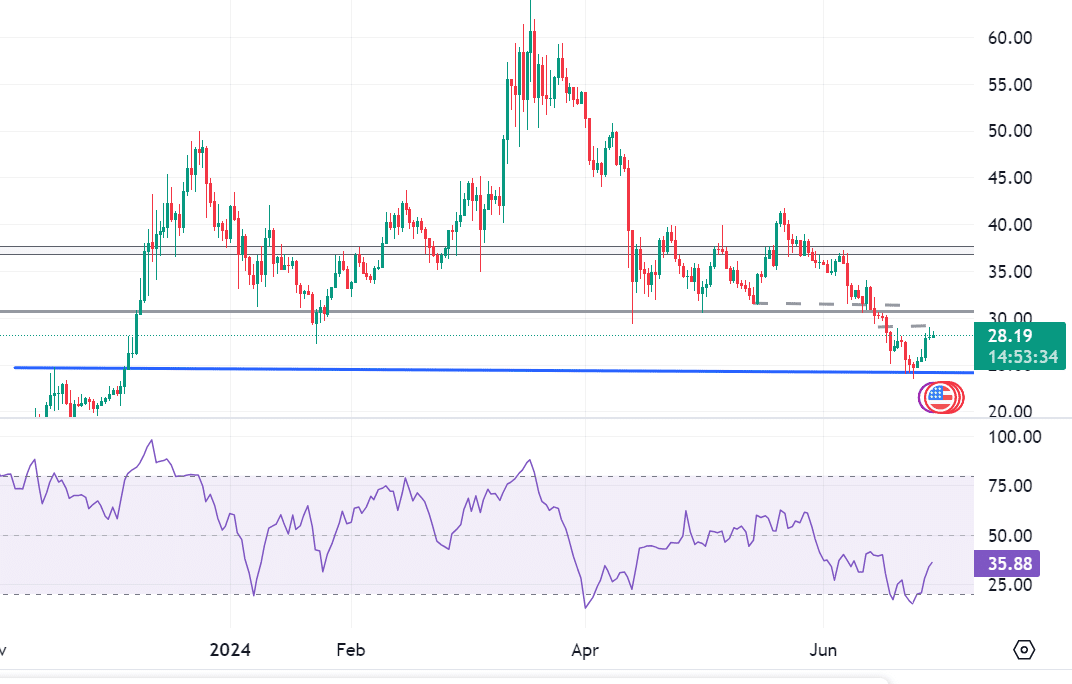

Source: Tradingview

Finally, the Money Flow Index (MFI) rose from 16 on June 24 to 35 at the time of writing.

A sharp rise in the MFI usually indicates increasing buying activity, leading to a transition from higher selling pressure to a bearish market.