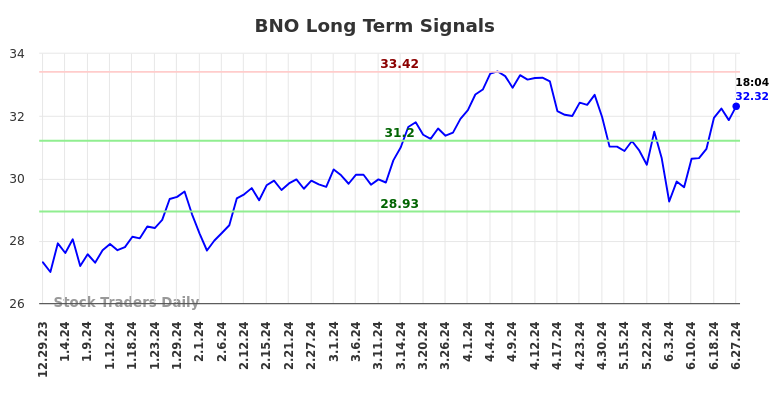

Longer-term trading plans for BNO

- Buy BNO just above 31.2, target 33.42, stop loss at 31.11.

- Short BNO just below 33.42, target 31.2, stop loss at 33.52

Swing Trading Plans for BNO

- Buy BNO just above 32.72, target 33.42, stop loss at 32.63

- Short BNO close to 32.72, target 32.13, stop loss at 32.81.

Day trading plans for BNO

- Buy BNO just above 32.29, target 32.72, stop loss at 32.21

- Short BNO close to 32.29, target 31.2, stop loss at 32.37.

Check the timestamp of this data. Updated AI-generated signals for US Brent crude oil fund (BNO) available here: BNO.

BNO Ratings for June 30:

| Term → | Vicinity | center |

Long |

|---|---|---|---|

| reviews | Neutral | Strong | Neutral |

| 1st place | 0 | 0 | 28.93 |

| place 2 | 31.97 | 32.13 | 31.2 |

| place 3 | 32.29 | 32.72 | 33.42 |

AI-generated signals for BNO

Blue = Current price

Red = resistance

Green = support

Real-time updates for institutional readers who read regularly:

Instructions:

-

Click the “Get real-time updates” button below.

-

At the login prompt, select “Forgot username?”

-

Enter the email address you use for Factset

-

Log in with the username/password you received.

-

You have access to real-time updates 24/7.

Click the “Get real-time updates” button below.

At the login prompt, select “Forgot username?”

Enter the email address you use for Factset

Log in with the username/password you received.

You have access to real-time updates 24/7.

From then on, you can get the real-time update at any time with a single click.

GET REAL-TIME UPDATES

Our leading indicator for a market crash isEvitar Corte.

-

Evitar Corte has warned of the risk of a market crash four times since 2000.

-

The Internet debacle was recognized before it happened.

-

The credit crisis was identified before it occurred.

-

The Corona crash was also recognized in this way.

-

See what Evitar Corte says now.

Get notified when our ratings change:Try it

This report was created using an AI developed by Stock Traders Daily. Over the last 20 years, this proprietary AI has been refined to identify the most favorable trading strategies for both individual stocks and the stock markets themselves. This method is also applied to index options, ETFs and futures. The goal of this specific report is to optimize trading in US Brent crude oil fund (NYSE: BNO) while incorporating prudent risk controls.

Warning:

This is a static report. The data below was valid at the time of publication, but support and resistance levels for BNO change over time, so the report should be updated regularly. Subscribers get real-time updates. Unlimited real-time reports.

Subscribers also receive market analysis, stock correlation tools, macroeconomic observations, timing tools, and protection against market downturns with Evitar Corte.

Instructions:

Instructions:

The rules that govern the data in this report are the rules of technical analysis. For example, when BNO tests support, buy signals emerge and resistance is the target. Conversely, a test of resistance is a sign to control risk or sell, and support would be the downside target accordingly. In any case, the trigger point is designed to be both an ideal place to enter a position (avoid trading in the middle of a trading channel) and to act as a risk control level.

Swing trades, day trades and longer-term trading plans:

This data is refined to also differentiate trading plans for day trading, swing trading and long-term investment plans for BNO. All of these are offered below the summary table.

Fundamental charts for BNO: