- Analysts claim that miners’ price influence on BTC has declined.

- However, the total supply of miners was over 100 billion US dollars and was therefore a decisive price factor.

Bitcoin (BTC) had returned to its three-month low of near $60,000 amid worsening negative sentiment due to several factors.

Market observers pointed to macroeconomic uncertainty, the Bitcoin miner crisis and an oversupply by various players, including planned repayments to Mt. Gox.

However, one analyst, Fred Krueger, had downplayed the impact of Bitcoin miners on BTC price action based on the amount held by top miners and the monthly supply. He said:

“These miners no longer matter to the price of Bitcoin. The top 5 hold a combined 34,000 BTC. Even if they sold half of everything they have, that would only be $1 billion, or 0.1% of the asset’s value. As for the new supply, these 5 generate 2,000 BTC per month. It no longer matters.”

No, BTC miners are still important

Marathon Digital, Clean Spark, and Riot Blockchain are among the largest public BTC miners by market cap. However, other analysts disagreed with Krueger’s argument.

One of them, James Van Straten, underlined that the selling pressure on the mining companies came mainly from unprofitable private mining companies.

“Public miners only own 20-25% of the hash rate. Many private companies holding BTC are going under/selling BTC. This is one of the main reasons why BTC struggles after every halving.”

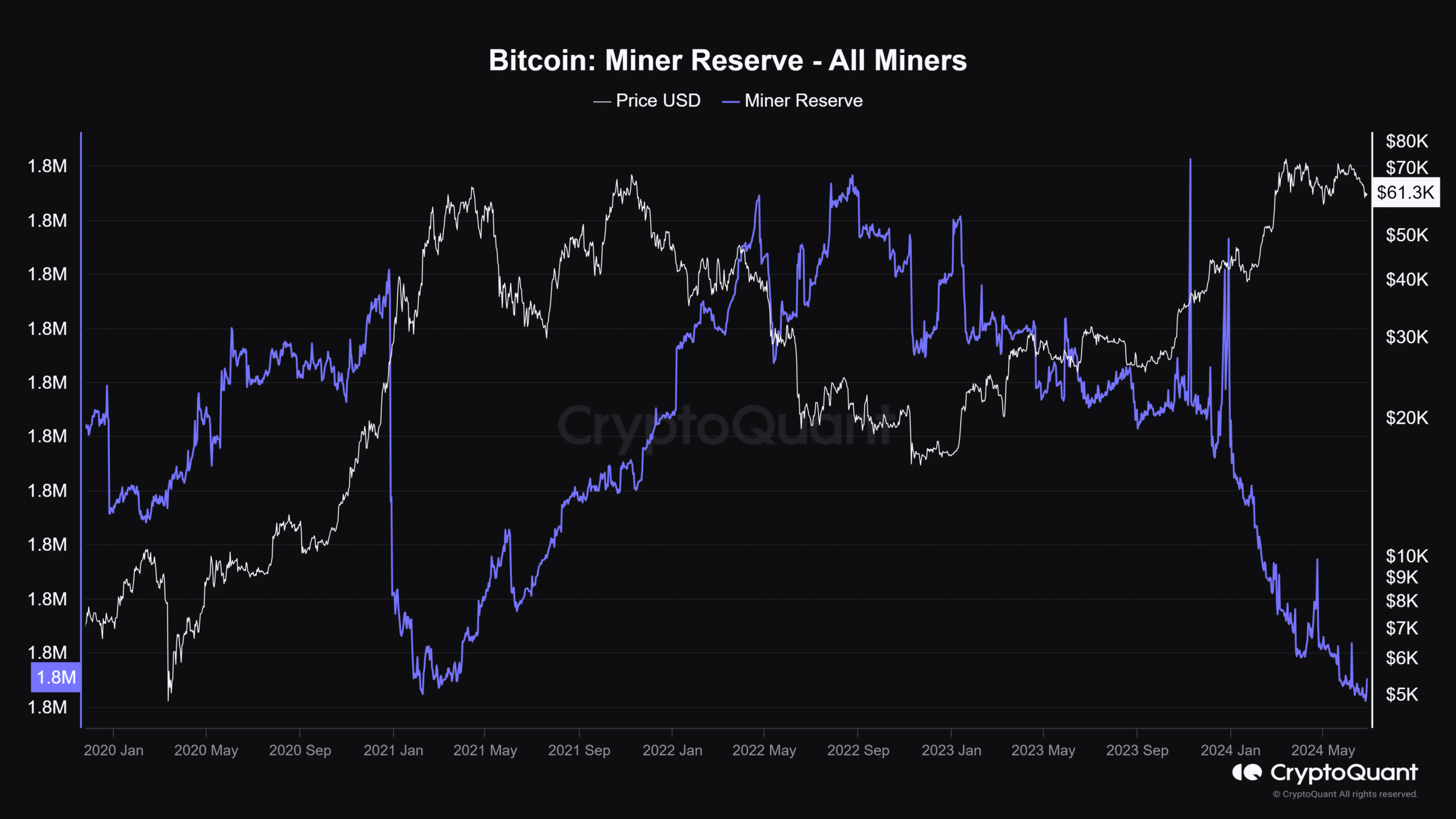

According to Straten, the miners’ total supply is an incredible 1.8 million BTC, worth about $109.8 billion at current market prices.

The analyst added that despite the decline in the total supply held by miners, the staggering amount still represents “constant selling pressure.”

AMBCrypto’s analysis of the total BTC miner reserve confirmed Straten’s assessment, with the value having fallen to 1.8 million BTC, which was in line with 2021 lows.

Source: CryptoQuant

A current AMBCrypto report found that BTC miner-to-exchange flow has decreased, meaning less BTC is being routed to exchanges for sell-offs.

However, this also meant that future price increases would give miners the incentive to sell their assets at higher profits.

Another analyst, Willy Woo, also said: groomed that the miners are still important.

“If you strip that away, you get the real long-term demand and supply. New investors, OG sellers, miners impulsively selling their new supply. Turns out they still matter.”

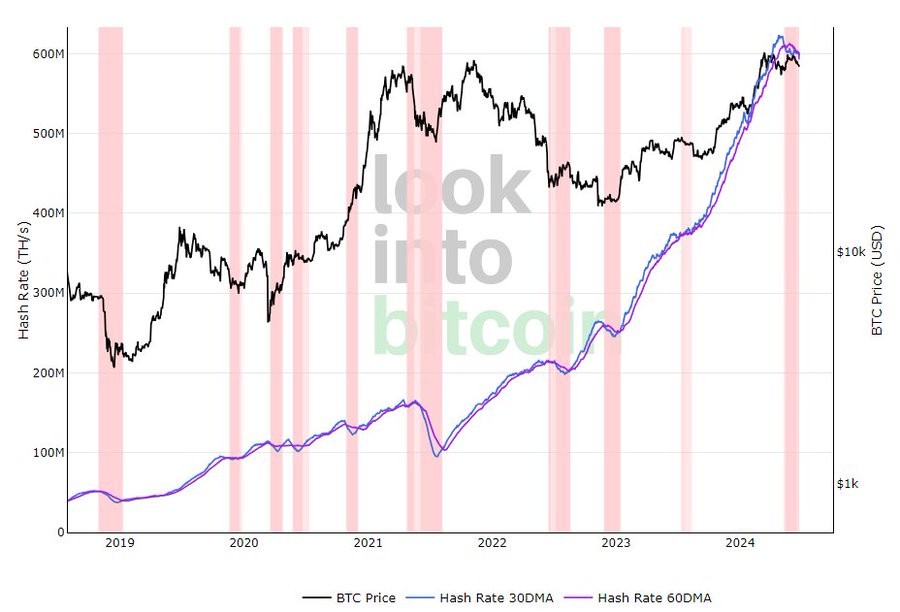

In the meantime, the miners’ capitulations were far from over and the hashrate remained low. A user noticed that the current capitulation is the longest since the crypto winter of 2022.

“Hashrate continues to fall. This is now the longest capitulation by #Bitcoin miners since the bottom of the 2022 bear market.”

Source: Look Into Bitcoin

Historically, BTC prices tend to rally whenever the hash rate increases, and if this trend continues, it could reinforce the idea that miners still have a say in BTC prices.